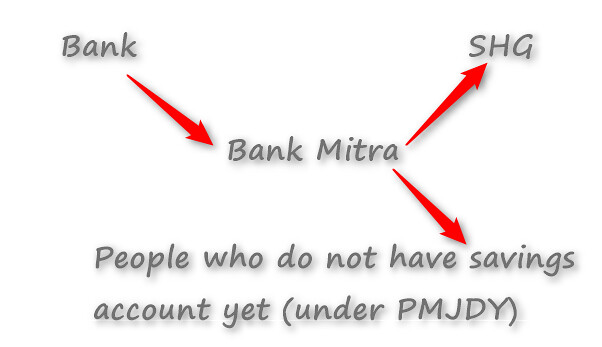

Definition

Bank Mitra shall be preferably a lady from amongst the community who is provided with the knowledge of doing subsidiary banking works like documents preparation of SHG’s for account opening, credit linkage, receipt filling in the bank when the members reach the bank premises either for withdrawing or depositing the amount and supporting the bank with such similar works as required by the branch.

Why Bank Mitra?

There is a purposive need to try the concept of Bank Mitra in order to ensure that they become instrumental in facilitating the community members through SHG’s make access to financial services.

Characteristics:

1. BANK MITRA shall preferably be a woman from the same cluster villages. S/he shall be preferably from the same community or SHG member or wards of the SHG members.

2.In case of unavailability of such candidate male candidate may be considered.

3. Very well versed with writing ability – confident to make interpersonal relations with the bank staffs and the community members.

4. At least 10th/8th pass and possess good writing and reading skills.

5. Patience by nature and have compassionate view and regard for poor women.

6. Must be vocal.

7. Should not have any constraints regarding mobility in the village and going to and forth to the near by bank premises – willing to attend to the bank premises during the office hours of the banks all through the month.

8. Should have the consent of the family members.

9. Shall be willing to liaison between the bank and the community.

10. Do remain prepared to attend to the SHG’s in their place in case of requirement to fulfill the procedural requirements of financial linkage be it savings account opening or the credit linkage.

Internship Model:

1.The BPIU shall be taking the consent of the related VO’s – to consider the name of the Bank Mitra.

2. After due training the candidate shall be placed to start the work in liaison with banks at the designated bank premise.

3. Put under the scanner for first 3 months.

4. During the first 3 months period, periodic training shall be undertaken according to the need arising.

5. Training cell at the district level shall be doing the training need assessment and preparing the modules to train them.

Job Responsibilities:

a. Provide support in doing subsidiary banking works like documents preparation of SHG’s and their federations for savings account opening.

b. Providing support in ensuring documentation of bank credit linkage.

c. Encouraging community institution/SHG’s to understand the rules and requirements of bank related to saving accounts, credit linkages, etc.

d. Become instrumental in facilitating the community members through SHG’s and their federations make access to financial services.

Remuneration:

I. Period of Internship – Rs. 1, 000 and a travel allowance of Rs.250 on a monthly basis.

II. After Internship – Rs.1, 750 and a travel allowance of Rs. 500 on a monthly basis.

Remuneration shall be paid through the BPIU of the related block – payment through Cheque after opening their accounts.

In case of non-performance, – shall be given 2 months’ time for improvement.

In relation to Pradhan Mantri Jan Dhan Yojana (PMJDY):

Business Correspondent Agents (Bank Mitras) are retail agents engaged by banks for providing banking services at locations where opening of a brick and mortar branch / ATM is not viable.

Functions:

a) Creating Awareness about savings and other products and education and advice on managing money and debt counseling.

b) Identification of potential customers.

c) Collection and preliminary processing of various forms for deposits including verification of primary information /data.

d) Filling of applications / account opening forms.

e) Collection and payment of small value deposits and withdrawals.

f) Receipt and delivery of small value remittances / other payment instructions.

g) Furnishing of mini account statements and other account information.

h) Any other service on behalf of the Bank, duly authorized by the appropriate authority etc.

Banks have been permitted to engage individuals / entities as Business Correspondent (Bank Mitrs) like

(i) Retired Bank Employees

(ii) Retired Teachers

(iii) Retired Govt. Employees

(iv) Ex-Servicemen

(v) Individual owners of kirana / medical/ fair price shops, individual Public Call Office (PCO) operators, agents of Small Savings Scheme of Government of India / Insurance Companies, ‘for profit’ companies registered under the Indian Companies Act.

References:

http://brlp.in/admin/Files/Policy%20Paper%20on%20BANK%20MITRA.pdf

https://www.sbi.co.in/portal/web/customer-care/-faq-pradhan-mantri-jan-dhan-yojana-pmjdy