Money is one of the most basic concept. Various questions are framed in the UPSC IAS Prelims exams from this topic. Also once you understand this very basic concept, it would be easier for you to understand more complex topics that involve money.

It is the commonly accepted medium of exchange, now a days.

Previously, bartering was the primary means of trade. It did not involve money. Rather goods were exchanged for another good. This was called double coincidence of wants.

However, many a times situation arose when what one person wanted was not required by the other, or there was an excess of supply of a particular good. In such cases, the value of good could not be determined.

For example, in a community there may be people who would be wanting to exchange 1 kg of rice with 1 kg of pulses. However, there may be abundance of people having supply of rice but fewer with supply of pulses. This would increase a demand for pulses. Hence, proper exchange would not be completed for all the people.

There may also be a case when some people would want to exchange 1 kg of tomato with 1 kg of pulses but there would be no one interested in such exchange in the nearby community. Also, how each good would be valued was also a difficulty.

To, eradicate all such problems money was introduced.

Money is valued. People are willing to accept it in exchange of goods and services.

It becomes an important instrument for facilitating exchange.

It, thus acts as an intermediate good, to facilitate the exchange of goods acceptable to both parties.

Advantages of money:

- It acts as an appropriate medium of exchange for an economy as a whole.

- Money can be measured i.e. its value can be determined.

- It is not perishable in contrast with any commodity, goods/services.

- It adds value to an individual’s wealth. You can buy property, gold, silver, bonds, etc. with money.

- It is universally accepted and it’s the most liquid form of all assets.

- It helps you to carry out transactions anywhere in the world.

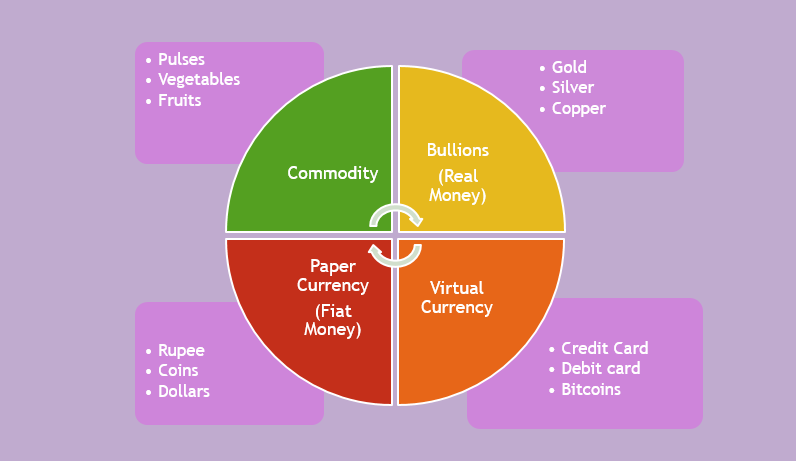

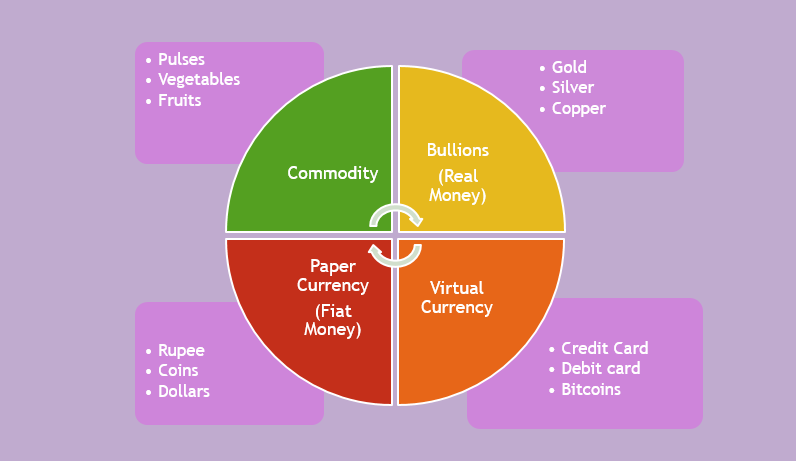

Types :

1. Real Money: Gold, silver and other precious metals are considered.

2. Fiat Money: Currency and coins are considered .

3. Virtual Money: Credit card, debit card, bitcoins, etc. are considered.

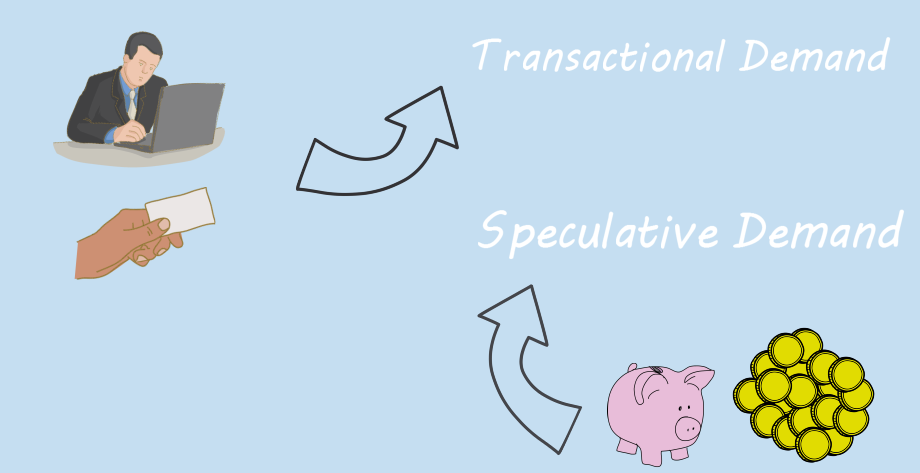

Why does demand for money arises?

It is due to:

1) Transactional Motive: to carry out any transaction for an individual’s need. E.g.: purchase of goods and services

2) Speculative Motive: To appreciate the wealth from it or rather earn interest from it, you are keeping a view about the future. E.g: purchase of land, gold, bonds, etc.

Demand for money in an economy is, therefore, composed of transaction demand and speculative demand.

Transactional demand is directly proportional to real GDP and price level.

Speculative demand is inversely related to the market rate of interest.

Supply of money

In a modern economy money consists mainly of currency notes and coins issued by the monetary authority of the country.

The present monetary system in India is managed by RBI. RBI is the central bank of our country.

In India currency notes are issued by the Reserve Bank of India (RBI), which is the monetary authority in India. However, one rupee note and coins are issued by the Government of India.

If someone produces the note to RBI, or any other commercial bank, RBI will be responsible for giving the person purchasing power equal to the value printed on the note. The same is also true of coins.

Currency notes and coins are therefore called fiat money. They do not have intrinsic value like a gold or silver coin. They are also called legal tenders. This is beacuse they cannot be refused by any citizen of the country for settlement of any kind of transaction.

Apart from this, balance in your savings/current account is also considered as money.

Why is savings/current account balance treated as money?

This is because to settle a transaction, you can draw a cheque against these accounts. These deposits are also called demand deposits because they are payable by the bank on demand from the account holder.

However, cheques drawn on savings or current accounts can be refused by anyone as a mode of payment. Thus they are are not legal tenders. This is because cheques (or drafts) are just an instrument for transacting but it has no value of its own.

You can also go for fixed deposits/recurring deposits to earn interest and such deposits are called time deposits. These are also not legal tenders.

Note: Demand deposits and time deposits are sometimes referred to as bank money.